Sustainability. Financed.

Financial consulting with emphasis on innovation and transformation

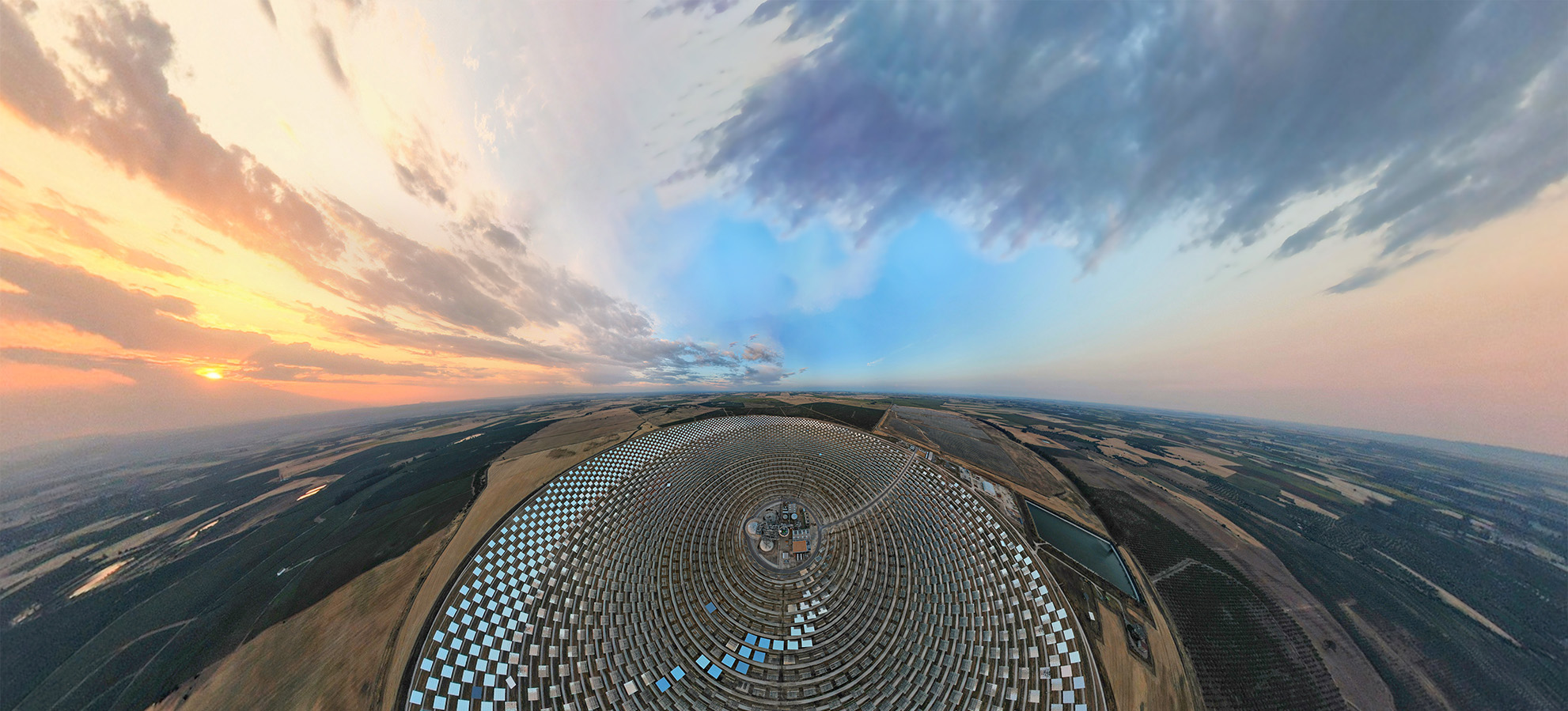

The decarbonization process requires a substantial overhaul of the industrial landscape. It entails the widespread adoption of sustainable technologies while simultaneously establishing new infrastructure for emissions-free energy supply.

Both the scaling of established transformational technologies and the implementation of innovations require considerable financial resources. Designing and executing the appropriate financing solutions for these projects is our core expertise.

Solutions that fit

We serve as advisors to corporations and sponsors on all matters related to financing innovative and sustainable technology initiatives. In this capacity, we take the responsibility of ensuring that the most optimal outcome, considering both time and cost factors, is achieved through rigorous and professional process management.

Capital is an abundant resource. However, without the right structure it remains unattainable.

Team

We are a team of deal engineers and project managers, who have successfully structured and implemented financing projects of over 20 billion Euro worldwide. We have a comprehensive understanding of transaction management and, thanks to our complementary competencies, are able to confidently handle all aspects of a financing transaction, including the financial model, legal, tax and accounting implications.

Reference

360 Asset Finance GmbH is a founding member of impact e.V., a non-profit association of globally operating financial institutions. The goal of impact e.V. is to align lending and investment activities in the aviation sector with the objective of decarbonization and to finance the sustainable growth of the aviation industry. Dr. Peter Smeets is a member of the board of impact e.V.